rms – Risk-Management-Suite

The comprehensive credit risk management suite

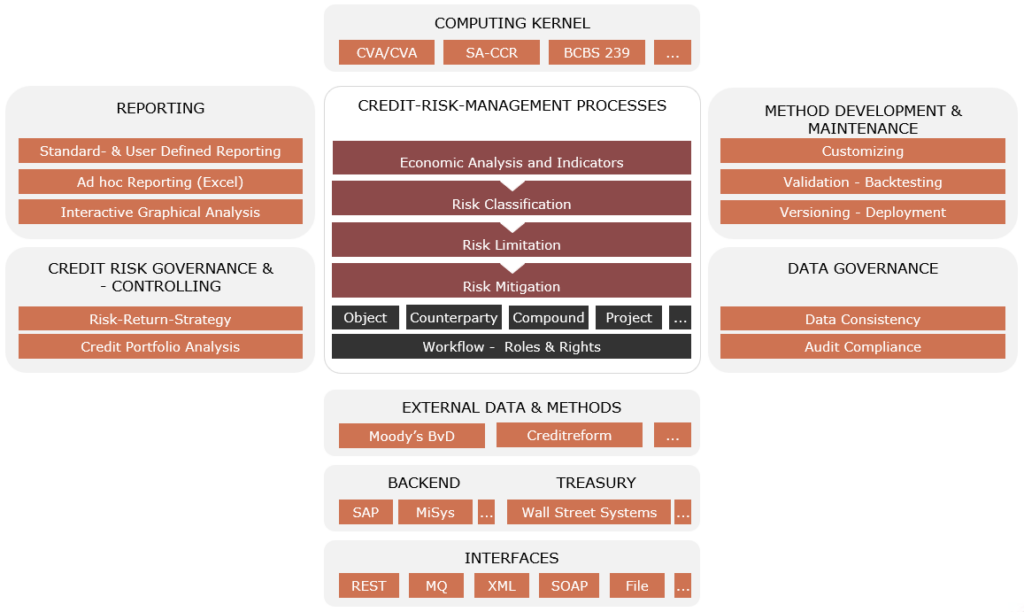

The risk management suite rms offers all the functionalities required for integrated credit application and processing. Thanks to the modular structure of the software, each customer can individually combine the modules and features that cover their desired range of functions. Thanks to its numerous interfaces, the software can also be flexibly integrated into any IT infrastructure.

The requirements of various stakeholders for reporting, data governance, the further development of valuation methods and credit risk monitoring and management are ensured by corresponding functionalities.

The risk management suite rms is a browser-based application, i.e. no specific local installation is required. The modern interface technology based on powerful UI frameworks enables smooth working with the ease of use familiar from the desktop.

rms Modules – Functionality – Interfaces

rms – Features und Properties

Business Key Features

> Flexible mapping of credit risk management procedures and processes

> Modular platform with which the scope of functions can be individually determined by the customer

> Complete configurability of the application by the user, e.g.

– Analysis methods

– Rating procedures

– Collateral valuation

– Limit structures

> Provosion of specialist functions such as

– External ratings for business partners / countries etc.

– ESG/CSS/self defined credit labels

– Handling of non-performing loans / forbearance

> Standardized, integrated recording and management of all data, individually according to customer requirements

> Audit compliance, e.g. through historization of all data including consistency assurance and 4-eyes principle

> Standard reporting with output in standard file formats or connection to existing reporting tools

Technical Key Features

> Cloud ready – out-of the box

> Frontend: Rich GUI via browser, business logic: Java, DB: Oracle/PostgreSQL

> Staging installation possible – separation of environments with automated transport procedures

> Reporting with output in standard file formats: XSLX, PDF

Easy expansion through additional options

> Powerful REST API for integration into your system landscapes & processes for the purpose of dark processing

> Method development, supported by backtesting and simulation functions and different environments, e.g. for test and productive operation

> Process modeling based on user segmentation and checklists to define a seamless execution of all necessary process steps

> e.stradis calculation kernels (CVA Calculator, SA-CCR; BCBS 239) build a bridge to Controlling & Accounting and offer additional reporting functions

> Risk-return optimization through integration with the e.stradis standard software pdm – portfolio decision maker

Additional Integration Options

> Interfaces to existing systems, e.g. SAP

> Interfaces to rating agencies, e.g. Creditreform, Moodys-BvD, S&P etc.

> Any other interfaces, e.g. REST, MQ-Series, SOAP, SQL for connecting external data sources

> Interfaces to standard reporting applications

Advantages

> High technical flexibility without programming and release effort

> Flexible integration scenarios thanks to modular structure and numerous interfaces

> In addition to the technical requirements of credit risk management, it also meets other requirements of controlling, accounting, auditing, supervision, etc.

> Low total cost of ownership

> Low maintenance costs

> Integration into any heterogeneous IT infrastructure

> High flexibility through interfaces

> Scalability of the application

> Company-wide roll-out with low investment costs for specific IT infrastructure